Networking Related News

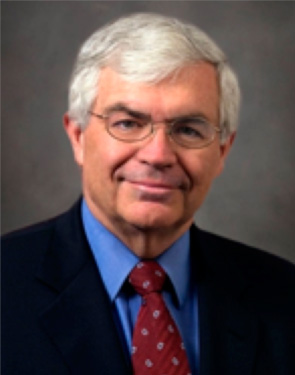

John Taylor, Prominent Economist, Kicks Off 2014 FWSF Industry Leadership Series

The Financial Women of San Francisco Industry Leadership 2014 kick-off luncheon on February 12, with about 80 attendees, featured John B. Taylor at San Francisco’s City Club. Mr. Taylor is a professor of economics at Stanford University and the George P. Schultz Senior Fellow in Economics at Stanford University's Hoover Institution. He is also a former Undersecretary of the Treasury for International Affairs and a former member of the President’s Council of Economic Advisors. Mr. Taylor has written extensively and won numerous awards, most recently the Hayek Prize for his 2013 book “First Principles.”

Read moreVoices of Experience – What FWSF is Learning about Mentoring

Forty-five women from the financial industry in San Francisco gathered to share their stories of being a mentor or a mentee on February 6, in a session focused on mentoring in FWSF entitled “Voices of Experience”. There were both members and guests of FWSF, including 14 current and past mentees and 11 current and past mentors from the FWSF Scholarship Mentoring Program. In addition to sharing their experiences, participants considered what FWSF has been learning about mentoring.

Read moreGetting Your “Oomph” Back In Your Job: Jan. 28 Professional Development Program With Sherry Jordana

Not eager to get out of bed on weekdays? Wondering whether your job could unleash more of your passion? Then you need to get your “oomph” back! Sherry Jordana showed us how in our first Professional Development program of 2014. Women who are in-between jobs, those employed but not satisfied, and others interested in making that job bring them more joy and energy participated in a lively and interactive program led by Sherry.

Read moreLessons from a 30-Year Career in Finance: An Evening with Ted Truscott

Ted Truscott enlightened an FWSF crowd with tales from his 30-year and still flourishing career during November's industry expert event held at the historic U.S. Bank building.

Read moreJoanne Medero on Derivatives Regulation After Dodd-Frank

On Tuesday, November 5, 2013, Joanne Medero, Managing Director of Blackrock, Inc., provided an impressive and informative presentation on the very technical area of "Derivatives Regulation After Dodd-Frank" to FWSF Members and guests.

Read more