Event Recap by Megan E. Morrice www.meganmorrice.com

On September 19, in a presentation that was part of the Financial Women of San Francisco (FWSF) Leadership Series, Dr. Jing Zhang, managing director and the global head of Moody’s Analytics Research and Modeling Group, brought a different perspective to the quantitative analysis field, one that was focused on financial inclusion. Although quants have been blamed for some misdoings of the past, and are known for structuring products like Collateralized Debt Obligations (CDOs), which played a critical part in the last financial crisis, Dr. Zhang emphasized the field’s many positive contributions.

The mission of FWSF— to advance the success of women in finance— is near to Dr. Zhang’s heart, He has three daughters ages 5-9, in whom he wants to encourage an interest in science, technology, engineering, and mathematics (STEM).

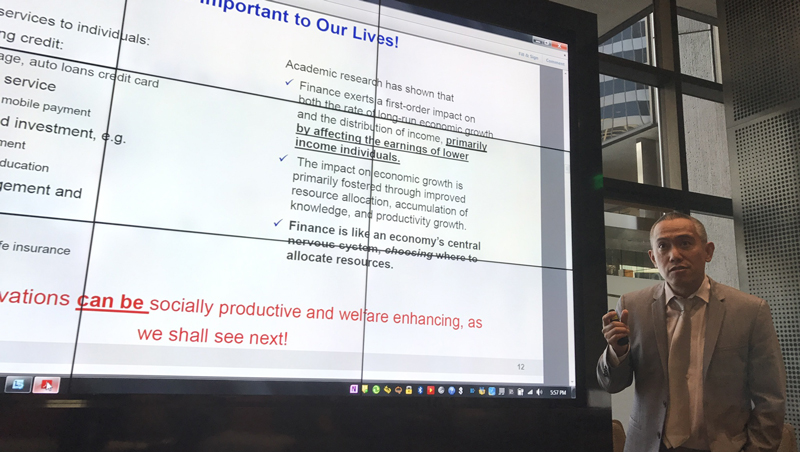

Dr. Zhang began the evening by covering some basics: what quants do and what finance is at its core. He posited that finance is the greatest invention of humanity, comparing finance to an economy’s central nervous system, deciding where and how to allocate resources. He described finance as a time machine, transferring value back and forth from the future to the present. While the industry has been involved in wrongdoings in the past, it has also been responsible for the creation of financial innovations that are socially productive and welfare enhancing. During his talk, Dr. Zhang presented three case studies, examining ways that quants have improved the day-to-day lives of many people through life insurance, credit, and index funds.

The first case study was about the birth of modern insurance in the 1700s, when two Scottish ministers wanted to find a way to take care of widows and children of deceased clergyman. After enlisting the help of a math professor, they created a fund to do just that. Astonishingly, by 1765 the fund had a value of £58,348 — just £1 short of the original fund size prediction! They performed statistical analysis on data such as death rates, and employed probability theorems like Jacob Bernoulli’s Law of Large Numbers. In doing so, they set the stage for the modern day insurance industry, which is rooted in statistical data and probability theory to this day.

Next, Dr. Zhang went on to discuss the origins of credit. Originally, access to credit was very discriminatory. In 1956, a small group of people thought computers would be useful in lending. Not many people shared their vision. They pitched it a couple years later to 50 lenders, and only one adopted it. In 1970, the Fair Credit Reporting Act was enacted to promote the fairness, accuracy, and privacy of consumer information in consumer reporting agencies. In 1989, modern FICO came into existence, and with it came the advancement of fairer credit decisions and credit access that is more available to a larger group of people. Of course, we still see examples today —such as the recent Equifax data breach — that show that we still have more work to do.

The final case study Dr. Zhang discussed was the innovation of passive investing in stocks through low-cost diversified index funds. The majority of actively managed funds (82% of U.S. large company funds, 88% of U.S. small company funds, and 84% of international funds) haven’t beaten their indexes over the last 10 years. Index funds have opened up the world of investing to a whole new population of people who were previously excluded from participating in investing through the stock market.

The pace of innovation in the financial industry is rapidly accelerating, especially during the last 20 years as we have seen the introduction of tech-enabled mobile banking, peer-to-peer lending, payments, crowdfunding, mobile-wallets and more. Today, the growth of big data, machine learning, artificial intelligence, and the blockchains have vast implications for the democratization of finance. New technology and lower transaction costs are increasingly fueling access to financial services for the traditionally underserved. New forms of underwriting based on borrowers’ social media presences and online footprints have been developed. There are big implications for quantitative researchers and technologists as they play a critical role in helping solve intractable problems like income inequality and climate change.