by Elizabeth Holt Andrews

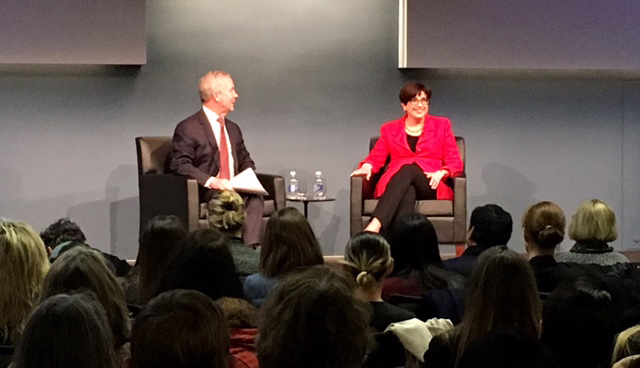

On January 24, 2017, the Financial Women of San Francisco partnered with the Harvard Club of San Francisco to sponsor a fireside chat between two of our city’s most distinguished citizens, Marie Chandoha and Bill Haraf.

Ms. Chandoha serves as the President and Chief Executive Officer of Charles Schwab Investment Management. Mr. Haraf is Special Advisor to the Promontory Financial Group and serves on the Board of Directors of the Charles Schwab Corporation.

The well-attended event, which took place in the Schwab Center on Main Street, kicked off with a networking reception with wine and hors d’oeuvres. Afterwards, Paige Venable, Managing Director of KPMG LLP and President of the FWSF, introduced the speakers.

Ms. Chandoha and Mr. Haraf engaged in a wide-ranging discussion on topics including the future of the bond market, anticipated regulatory changes to the financial services industry under the new Trump administration, the effect of Brexit and upcoming European elections on the global economy, and ideas for increased transparency as a means of regaining consumer trust in financial institutions.

Ms. Chandoha predicted additional rate increases from the Federal Reserve during the next four years, and noted the increase in volatility in the bond market since the November 2016 election. She also observed that President Trump is very comfortable with the notion of debt, whereas many other leaders in the Republican party have built their careers on the concept of fiscal discipline. She anticipated some resulting tension, but opined that ultimately the President and GOP leaders would compromise and end up somewhere in the middle on the question of large infrastructure spending.

Both speakers voiced worries about an aggressive, mercantilist approach to trade, commenting that far more people in the United States lost their blue-collar jobs because of innovations in technology than because of globalization. Indeed, if factories are indeed brought back onshore as President Trump wants, they are likely to be highly automated. The best solution, the speakers commented, was aggressive re-training of the American workforce in order to meet the needs of the new economy. Ms. Chandoha noted, in particular, that the Schwab workforce was constantly retraining itself and her own company’s habits of continual ongoing education served as a model for her own thinking on the subject.

The evening concluded with a lively question-and-answer time. Audience members sought the speakers’ opinions on—among other things—how to increase hiring and retention of women professionals in the financial services industry, how to leverage recent innovations in technology to deliver financial services more accessibly, and tips for interviewing and career advancement.

FWSF thanks both of these eminent and highly respected financial professionals for sharing their views with our members and guests.