Industry Leadership Series – East Bay

By Tayyaba Shafique

On November 1, 2017, the Financial Women of San Francisco and UC Berkeley’s Haas School of Business had the pleasure of learning from Cristina Dolan, founder and COO of InsideChains and co-founder and COO of iXledger, about how technology is transforming financial markets. Susan Mazzetti of FWSF introduced Ms. Dolan, who gave an overview of the opportunities the transformation creates within business models and workflows. The financial revolution she spoke about includes the use of crypto-currencies, blockchain, and robo-advisors.

Cristina began her discussion by introducing the concept of trust in business as something that could be measured and tracked over time, which is important because public trust in financial services was at an all-time low when alternative crypto-currencies began to rise. Trust is also an essential component in conducting business, and the blockchain was introduced as a key player in shortening the time between contract execution and payment, since currently a large percentage of businesses fail because they don’t receive payments on time.

Blockchain picked up traction because it is trusted, explained Cristina. It is essentially a ledger which is mathematically protected and immutable, and copies of the ledger are shared, which decentralizes the recordkeeping. It is technology based on transparency of information, communication, and transactions. The transactions go through validation and proof of work before they are mathematically locked and cannot be undone, only added to.

The ingredients of trust and an immutable and distributed ledger brought Ms. Dolan to the next topic — crypto-currencies. BitCoin was used as an example since it is well known; however, we learned that many different crypto-currencies exist. The coin is the currency used to complete transactions using the blockchain, which verifies ownership of the asset. It is the asset used in exchange for goods/services; however, rather than waiting for a check to clear through a traditional bank, the blockchain quickly verifies the buyer has the funds, which are then transferred to the seller.

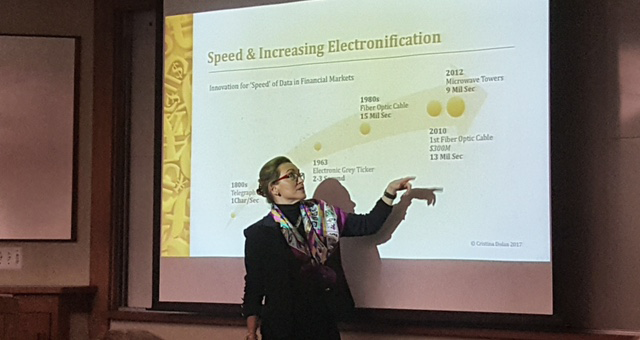

Components of a digital currency include the coin itself, with stored value, the conduit, which is the peer-to-peer transaction, and the blockchain, which is the distributed ledger establishing trust and transparency while streamlining business procedures. This technology has the ability to change the way transactions take place and contracts are executed in a similar fashion to how e-commerce has changed the shopping experience and shared economies have allowed individuals to customize their experiences. The new networks create new business models as data flow speed becomes increasingly important.

The blockchain ledger can contain a lot of data, data which has become the “new oil,” as explained by Cristina. In fact, she said, it has been forecasted that by 2025, 163 trillion gigabytes of data will exist, and will be able to be used by artificial intelligence (AI) systems in order for them to detect patterns to maintain a competitive advantage and make informed business decisions.

Data is already being used by robo-advisors to create “data lakes.” Individual classes of data, like customer, economic, and environmental events, are pooled together. With the right algorithms, the advisor can allow for easy planning and execution for different conditions. Using artificial intelligence, the synthesizing of data helps businesses make decisions more quickly, while reducing costs, risk, and fraud.

In summary, we learned the blockchain is a powerful technology that utilizes a trustworthy verification method to complete transactions and carry information. The room for innovation only grows as the data points used in the irreversible and immutable ledger can be extracted and analyzed to power new services and operations over time. The technology creates so many possibilities!

We are very grateful to have learned so much valuable information from someone so credentialed, and thank Cristina for imparting knowledge which is sure to be useful in the near future.