Over 50 FWSF participants joined Charles Schwab & Co. employees for a private screening of "Girl Rising." This sold out event was held at the Schwab Center in San Francisco on May 29, 2014. From Academy Award-nominated director Richard E. Robbins, "Girl Rising" is an innovative new feature film which tells the stories of nine extraordinary girls from nine countries who overcame incredible odds to get an education.

Read more

“Miracle” became the evening’s buzz word as Don Colman, Senior Regional Marketing Director at Putnam Investments, walked attendees through the wonders of the Apple iPad. The presentation, “Make your iPad Work for You,” was hosted by FWSF’s East Bay Committee on May 7, 2014 at Merrill Lynch Wealth Management offices in Walnut Creek. Colman, a self confessed “iPad geek,” taught himself how to maximize iPad’s capabilities. Sharing that knowledge with others is now a passion, he said.

Read more

Professor Holly Schroth led an entertaining and interactive workshop about negotiation skills to a sold-out crowd in April in our third Professional Development program in 2014. Holly emphasized that successful negotiations aren't about "win or lose" but rather are about problem solving. Holly highlighted the following "sins of negotiation," all of which are related to poor preparation: 1. Settling for too little 2. Leaving money on the table (because you don't know enough about what you are negotiating for) 3. Walking away from the table when there is a good offer 4. Settling for terms that are worse than your alternative (this can set precedence for future deals)

Read more

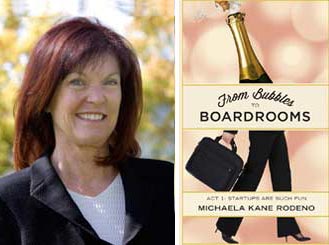

As part of Financial Women of San Francisco’s Industry Leadership series, author and retired wine industry executive Michaela Rodeno spoke about her experiences. Tracing the arc of her career development from its unlikely beginnings in early 1970s Napa, to being part of the (initially) two person team that launched Domaine Chandon in the U.S., to her role as CEO of St. Supery Winery, Michaela energized the sell out crowd on Thursday, April 3rd.

Read more

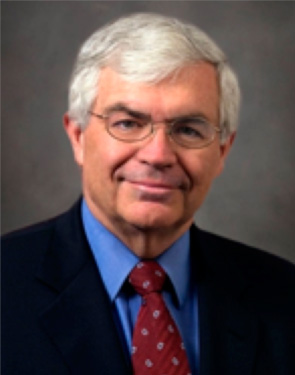

The Financial Women of San Francisco Industry Leadership 2014 kick-off luncheon on February 12, with about 80 attendees, featured John B. Taylor at San Francisco’s City Club. Mr. Taylor is a professor of economics at Stanford University and the George P. Schultz Senior Fellow in Economics at Stanford University's Hoover Institution. He is also a former Undersecretary of the Treasury for International Affairs and a former member of the President’s Council of Economic Advisors. Mr. Taylor has written extensively and won numerous awards, most recently the Hayek Prize for his 2013 book “First Principles.”

Read more

Forty-five women from the financial industry in San Francisco gathered to share their stories of being a mentor or a mentee on February 6, in a session focused on mentoring in FWSF entitled “Voices of Experience”. There were both members and guests of FWSF, including 14 current and past mentees and 11 current and past mentors from the FWSF Scholarship Mentoring Program. In addition to sharing their experiences, participants considered what FWSF has been learning about mentoring.

Read more

Not eager to get out of bed on weekdays? Wondering whether your job could unleash more of your passion? Then you need to get your “oomph” back! Sherry Jordana showed us how in our first Professional Development program of 2014. Women who are in-between jobs, those employed but not satisfied, and others interested in making that job bring them more joy and energy participated in a lively and interactive program led by Sherry.

Read more

Our annual Holiday Party was a huge success. During the live auction members had the chance to purchase unique holiday gifts for those special people on their list. Proceeds from the auction benefit the FWSF Endowment.

Read more

Researchers have spent a great deal of time exploring the behavioral differences between women and men when it comes to investing. Which gender makes for more successful investors? Is one sex more prone to making emotional decisions? By analyzing such areas, research has ultimately painted a picture on which gender is a more successful investor.

Read more

The FWSF Board recognized Erin McCune, partner at Glenbrook Partners, as its Distinguished Member of 2013 for her tireless efforts on behalf of the organization. Erin was the driving force behind the organization's rebranding and new website, all while maintaining a partner workload at a boutique consulting firm. Her perseverance, expertise, and effective leadership guided our organization through the process of implementing needed upgrades in technology, branding, marketing and communication. What an amazing accomplishment!

Read more

San Francisco’s current reign as an international “super core” target for real estate investors will continue for two or three more years, but already there are warning signs of a bubble market. That is the consensus of a panel of San Francisco real estate executives made up of Swig President and CEO Jeanne Myerson, BRE Properties CEO Connie Moore, and economist Ken Rosen. The three spoke at a panel sponsored by Financial Women of San Francisco. It was moderated by Julia Wilhelm, a managing director with Studley, a commercial real estate brokerage.

Read more

The FWSF mission of bringing women together to achieve great things is near and dear to my heart. Not only do I feel so grateful to have been supported by an FWSF scholarship during my second year of business school at Stanford, but I also have had the privilege of seeing the same, powerful mission at work for young women on the other side of the world.

Read more

Ted Truscott enlightened an FWSF crowd with tales from his 30-year and still flourishing career during November's industry expert event held at the historic U.S. Bank building.

Read more

On Tuesday, November 5, 2013, Joanne Medero, Managing Director of Blackrock, Inc., provided an impressive and informative presentation on the very technical area of "Derivatives Regulation After Dodd-Frank" to FWSF Members and guests.

Read more

Our panel, including FWSF member Erin McCune, discusses how new payments networks, some utilizing virtual currencies like Bitcoin and Ripple, have the potential to improve the financial system by reducing payment-transaction costs for consumers, small businesses, and nonprofits, both domestically and internationally. Public acceptance and usage is growing fast, but from a small base. At the same time, these alternate payment schemes have attracted the attention of regulators and law enforcement concerned about their potential usage for money laundering and criminal activity. Are they the future of payments or a playground for criminals?

Read more